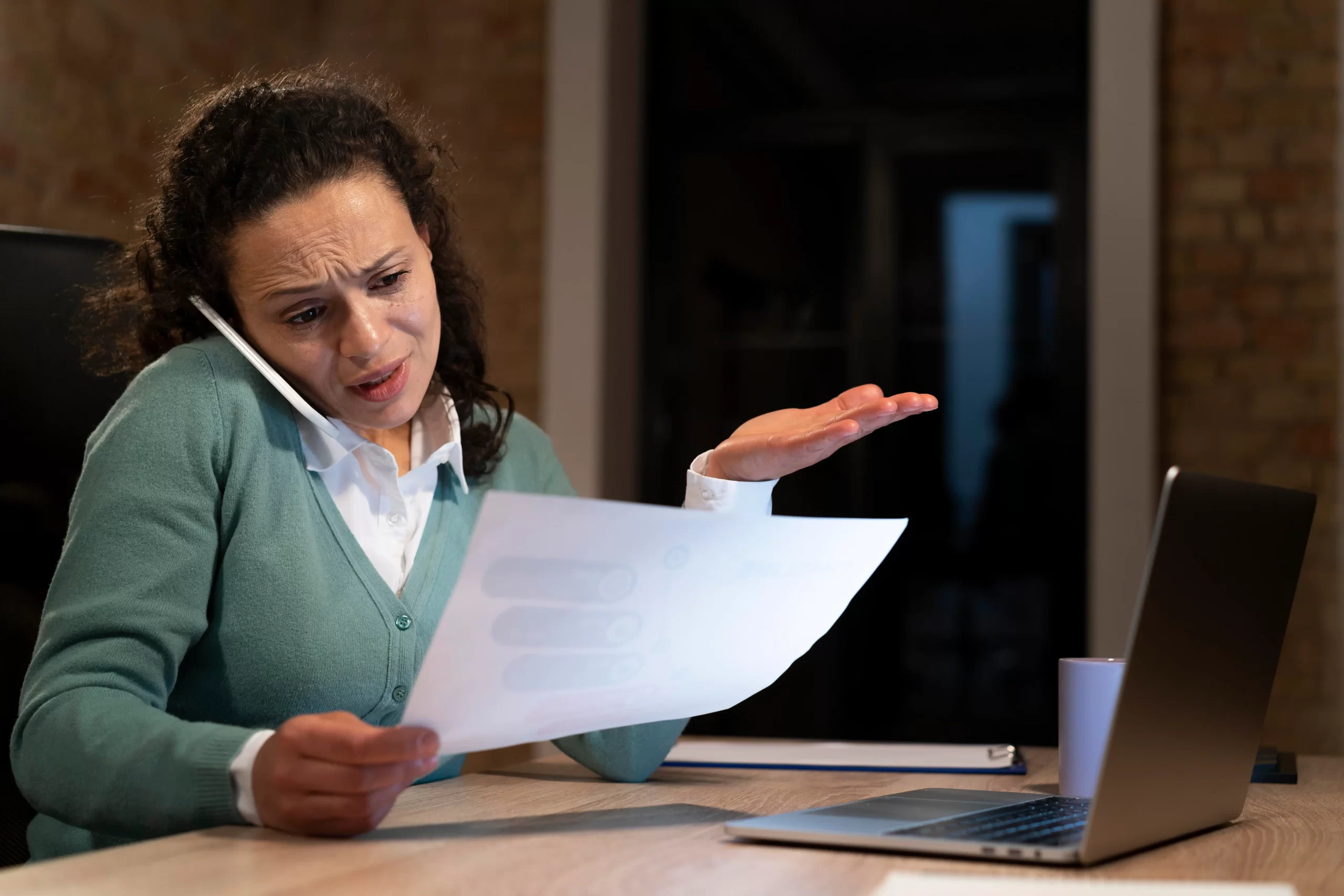

IRS Tax Resolution Services In Centreville, VA

Feeling anxious about an IRS tax audit in Centreville, VA? Don't let the worry consume you. Our team of seasoned IRS tax resolution experts in Centreville, VA, is here to offer precise and dependable assistance for all your tax concerns. Whether you need to negotiate with the IRS or develop a personalized solution, we are dedicated to ensuring your peace of mind. Reach out to us today, and let’s collaborate to secure your long-term financial stability.

40+ Professionals

30+ Years of Experience

6000+ Happy Clients

4.7/5 Rated On Google